How to activate the second dynamic password of Capital Bank

Considering the ever-increasing expansion of payment methods and the growth of their misuse methods in today’s era, increasing the security of bank transactions is one of the main challenges of banks. Absence, like online payment gateways, increasing the security of these types of transactions has been given a special priority. Therefore, in order to protect the accounts of its esteemed customers and to provide a completely safe environment for them to perform non-present card-based financial transactions in the digital space, the new service of the Bank’s encryption system, which focuses on the use of applications (software) mobile) The capital encryption program It has been designed and implemented, as described in the following details. With the use of the mentioned system by customers, it will be possible to generate dynamic and one-time codes in transactions based on the second code of capital cash cards.

Dynamic password activation guide for other banks

Video methods of receiving the second dynamic password of Capital Bank

Video tutorial on how to activate the capital encryption program through Internet Bank

Activation by visiting Kafilim Bank branches

The capital encryption program

Tips and prerequisites

- In order to activate the encryption program and use it to receive a one-time password to enter the Internet Bank, enter the Internet Bank through the static password that you received from one of the bank branches and through the Internet Bank settings menu and according to the program’s guide file regarding activation. Use your one-time password.

- In order to activate the encryption program and receive the one-time password to enter the Internet Bank and the second one-time password of the card, you can enter the Internet Bank after installing the program, having the password to enter the Internet Bank of Capital, and in the settings section according to the help file regarding activation Use your second one-time password.

Features of the capital encryption program

- Customers do not need to pay any fees

- No failure, battery depletion, loss, etc. compared to hardware models

- The possibility of activating the software through the Internet of Capital Bank and without the need to visit the bank branch in person

- More security compared to USSD-based encryption software

- The possibility of receiving a one-time password to enter the Internet Bank and Mobile Bank of Capital

- Ease of installation process

Installing and activating the software

First of all, the application “Kapital” from Capital Bank website Or the website of Iran App download page Capital’s dynamic code program Download and install it on your mobile phone.

Note: The app is available for Android and IOS operating systems.

Note: If your phone’s operating system is IOS, after installing the software, you must trust it from the phone’s settings.

By clicking on the software icon, the above page will be displayed to the customer

Internet bank password and bank mobile

- Enter the Internet Bank with the username and static password (the password you received from the Capital Bank branch to enter the Internet Bank).

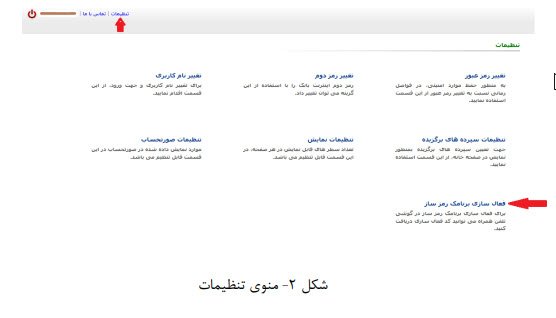

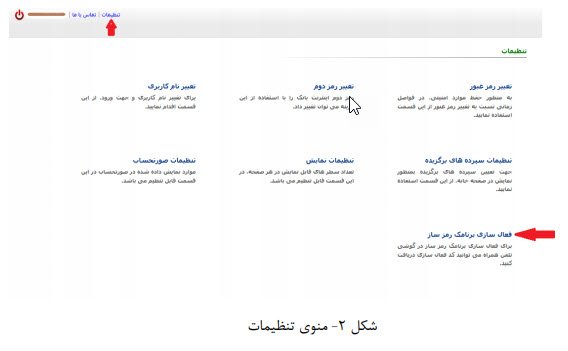

2. In the settings section, select the option to activate the encryption program.

3. Then click on the option of the second one-time password of Internet Bank and Mobile Bank, and on the next page, select the option of activating the encryption program. (Figures 3 and 4)

4. By selecting the option to activate the encryption program, a 4-digit code will be sent to your mobile number defined in the bank system, which is your activation code. In addition, a two-dimensional barcode (QRCODE) will be displayed on your internet bank page.

5. Now run the capital coder software and scan the image code displayed. By scanning the image code, you will be asked for an activation code (Figure 6).

- After entering the activation code, you should consider a 6-digit code for your app and enter it on the password request page. (Figure 7)

6. After entering the program password, a one-time password will be displayed, which can be used to enter the Internet Bank. (Figure 8)

Note: Every minute, a password is generated for the customer’s use, which can only be used once at the time of generation.

Note: If the number of incorrect logins to the Internet Bank exceeds the limit, your username will be blocked for 24 hours.

The second password of the card

There are two ways to activate the card’s second one-time password. One method is that the customer can activate the program without going to the branch and only by logging into the Internet of Capital Bank, and the second method is that the customer can go to the branch in person and have the activation actions performed by the branch user. In the following, both methods are fully explained:

ALof. Activation through the Internet of Capital Bank

- Log in to the Internet Bank with your username and static password (the password you received from the Capital Bank branch for accessing the Internet Bank).

- In the settings section, select the option to activate the encryption program.

- Then click on the option of the second one-time use code of the card and on the next page, select the card number for which you want to activate the second one-time use code (Figures 3 and 4).

- By clicking on the activation of the encryption program, a four-digit code will be sent to the mobile number defined for you in the bank, and a QRCODE will be displayed on the internet bank page. Scan this QRCODE through the application. After scanning, you must enter the four-digit code that was sent to you into the application, and then enter the 6-digit code that you have planned for the program. (Figures 5, 6 and 7)

tip: If you have previously chosen a password for the program, enter the same password; Otherwise, enter any 6-digit code that you want to consider as the program code. Be careful that you must remember any password you register as the program password and enter this password whenever you are asked for the program password when entering the program.

- After entering the SMS code, one-time codes will start to be generated automatically.

- If you have activated the one-time code for one of your cards, and you want to activate it for another card, there is no need to receive the QRCODE again. Just select the desired card number on the top page (Figure No. 9) and click on the add card option.

A customer’s visit to one of the branches of Capital Bank

The customer must go to one of the branches of the capital bank and submit his request for the activation of the application.

tip: The customer must inform the branch user of the card numbers for which he wishes to receive a one-time password.

In the branch, a 2D barcode is printed and given to the customer for scanning through the software. After scanning the barcode, you must enter the app password.

tip: If you have previously chosen a password for the program, enter the same password; Otherwise, enter any 6-digit code that you want to consider as the program code. Be careful, you must remember any password you register as the program password and enter this password whenever you are asked for the program password when entering the program.

- At the same time, an SMS containing a four-digit code for activation is also sent to the customer.

- After entering the SMS code, one-time codes will start to be generated automatically.

tip: If you enter the one-time password incorrectly more than three times, your card will be blocked. To get out of the block, you can get the second code of your card from the Capital ATM again and use the received code to perform your card transactions in person. But your card is also blocked in the Encoder program. From the one-time use code generated by the application, you must go to one of the branches of the Capital Bank.

Frequently asked questions of the capital program system

In order to protect the accounts of its esteemed customers and to provide a completely safe environment for them to carry out non-present card-based financial transactions in the digital space, Capital Bank has introduced the new service of Bank Capital’s encryption system, which is based on the use of an application (mobile software). ) the capital encryption program has been designed and implemented.

No. You need to visit the ATM in person to receive the dynamic password activation code.

No. Currently, this service is available for owners of Android and iOS smartphones.

Yes, you can deactivate the dynamic password of Capital Bank after activating it.